Put Intangible Drilling Costs To Work This Year To Cut Your Tax Burden

It’s the last week of the year and you have a tax problem. A good problem of sorts: You’ll be writing a big check to the IRS next spring, minus some kind of quick intervention. In the final weeks of 2018, what options do you have that could substantially reduce your tax burden?

Let’s consider President Ronald Reagan, and go back to the year 1986. Congress passed a bipartisan sweeping Tax Reform Act and President Reagan signed it into law as the second of the “Reagan Tax Cuts.” In the bill, specific tax considerations related to domestic oil and gas development were established, creating what Newsweek would later say “is the very best tax advantaged investment.”

Specifically, Intangible Drilling Costs (IDCs) were allowed to be deducted against active income. Typically, oil and gas exploration was considered a passive activity for most investors. That changed under President Reagan, at least from a tax perspective.

Specifically, Intangible Drilling Costs (IDCs) were allowed to be deducted against active income. Typically, oil and gas exploration was considered a passive activity for most investors. That changed under President Reagan, at least from a tax perspective.

For the typical taxpayer, passive activities (real estate investing, rental income, etc.) create larger deductions than active income (salary, commissions, sales of goods or services). Therefore, many high-income taxpayers leave money on the table, because they generally end up with more active income and not enough active deductions. The Tax Reform Act of 1986 provided an excellent alternative to this dilemma.

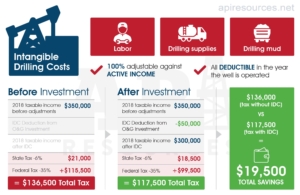

Intangible Drilling Costs comprise about 80-percent of the total cost of a drilling project and include such things as labor, drilling mud and supplies. Think of it as all the costs incurred that don’t drive away when the hole is completed. This substantial part of exploration can be deducted against active income, 100-percent in the year they are incurred.

Back in the late 1980’s and 90’s this caught on as one of the best tax breaks for wealthy individuals that had ever been created. In other words, it worked exactly as President Reagan and Congress anticipated. In the early and mid 80’s, oil prices were way down, similar to today, and drilling had come to a near halt. This Act re-stimulated domestic oil exploration, as tens of thousands of high-income earners jumped into domestic oil and gas working interest ownership, reducing their tax burdens, and in many cases, creating consistent monthly income from producing oil and gas wells.

Today’s oil and natural gas prices are creating a significant buying opportunity for both investors and taxpayers. From the tax perspective, the entire drilling operation is eventually written off your taxes (IDCs at 100-percent in the year incurred and the remaining tangible drilling costs are amortized over 5-7 years). From an investment perspective, once prices turn, history indicates there will likely be a substantial reversal to the upside. So if you were investing in oil and gas, would you rather buy at the top, when prices are high but likely to turn down (monthly income goes down) or, begin participation when prices are low, with the expectation that in coming months, monthly check sizes could increase?

Only A Few Weeks Left to Act

We currently have two prospects that will allow you to take advantage of year end deductions.

To find out more about the JM McClure #3 & #4 Prospect, you can reach us today at (214) 427-1761.

Leave a Reply

Want to join the discussion?Feel free to contribute!